Success story of Thurgauer Kantonalbank

«The overall impression of the tool is very professional. You can see the assumptions that are used. This prevents misunderstandings.»

«The overall impression of the tool is very professional. You can see the assumptions that are used. This prevents misunderstandings.»

Customer feedback on the user experience with the Omnium consulting suite

Omnium – a holistic consulting solution

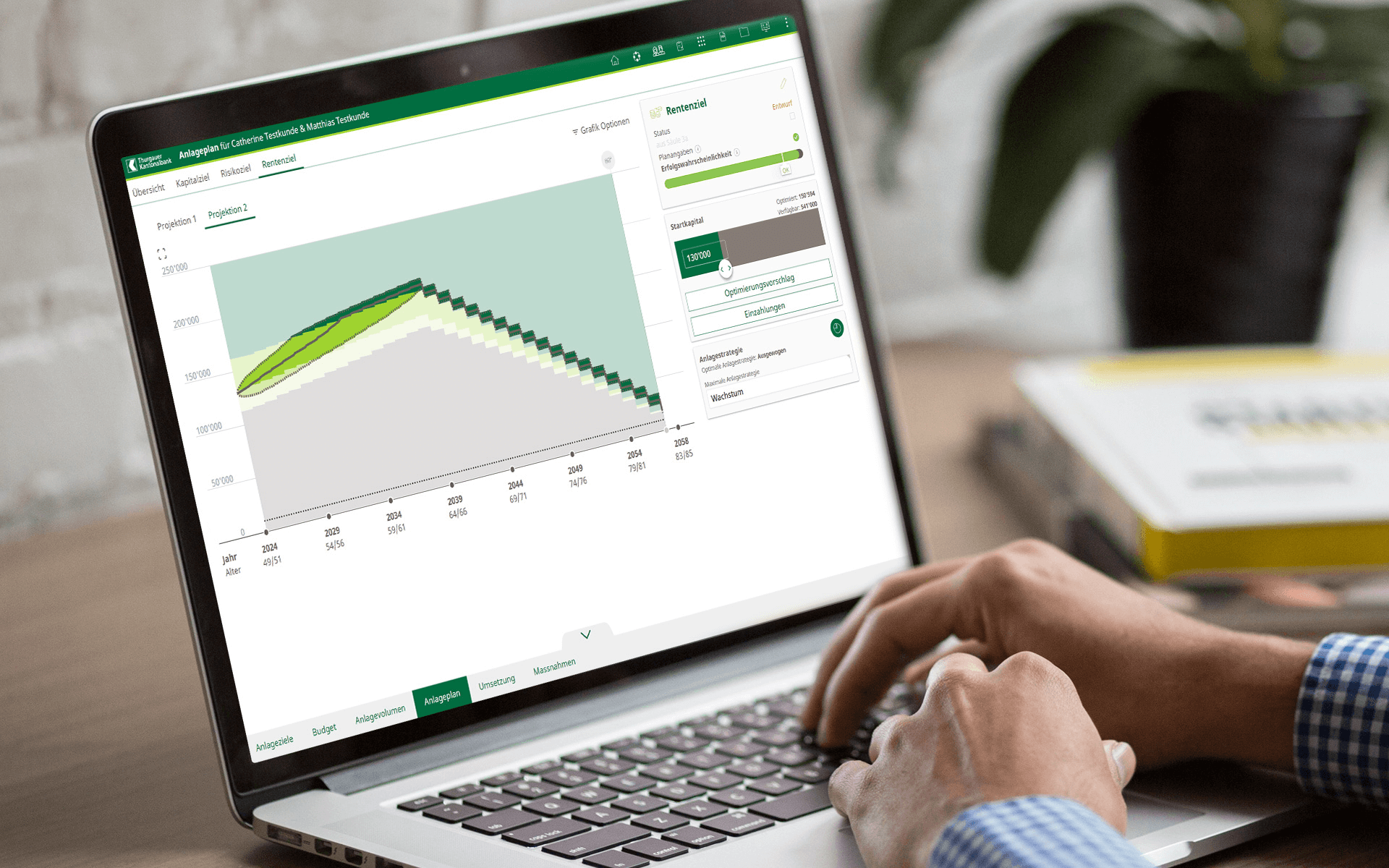

Thurgauer Kantonalbank (TKB) relies on a sustainable business model to meet customer needs through professional and personal advice. Customers should be able to rely on competent advice as well as benefit from a strong online offering. To strengthen its customer loyalty, TKB has further expanded its digital customer contact points and has been using the Omnium consulting tool for customer consultations since spring 2021.

Cooperation to optimize results

The introduction of the new advisory suite took place in close collaboration with Braingroup as well as other cantonal banks. Until then, TKB had used several isolated software solutions in addition to Avaloq. These have been replaced by a comprehensive omnichannel solution. To make the tool quickly available to TKB employees, the first modules were implemented using the standard modus in 2021 (including basic advisory, pension provision, life and pension planning, finance (purchase business transaction only) and taxes)

Enhancements took place in several steps. The life and pension planning module has been gradually expanded since its introduction. In Finance, business transactions such as new construction and redemption were rolled out in spring 2023, while increases and changes are planned for 2024. The investment module was designed and developed in partnership with BKB/Bank Cler. TKB introduced the module in the market in May 2023. The Inheritance & Bequeathing module was also created in collaboration between three cantonal banks. Introduction is planned for spring 2024.

Cooperation between banks and Braingroup has increased the quality of the tools, lowered development costs and led to a rapid market launch.

An increase in customer experience and efficiency

Innovation created added value. Consultations have become interactive customer experiences. The complexity of a conversation has been reduced through standard inputs, integrated calculations and simulations. Quality of advice and customer experience are improved through guided processes and meaningful visualizations while flexibility for giving advice of varying scope or depth is always given.

In recent years, the number of customer consultations carried out with the Omnium consulting suite has gradually increased. This underlines its popularity among both consultants and customers. In addition, efficiency was at the heart of the project. The extensive integration with Avaloq and third-party providers such as swissQuant and Wüest Partner reduces the efforts of capturing data and enriches the modules through simple representations of the customer’s current financial situation and future projections in form of scenarios.

Upstream and downstream value creation processes such as new customer acquisition and the inclusion of back-office processes are now included in the Omnium consulting process. Requested services and products can so be provided to the customer already during the consultation which creates customer delight.

Overall, the Omnium front-end consulting suite marks a significant advance and positions TKB as a pioneer in hybrid consulting.